How Does a Toyota Lease Work?

If you're looking for a new Toyota, consider leasing as an alternative. Leasing a Toyota can be a great way to get the vehicle you want without the commitment of a long-term purchase. One popular car brand for leasing is Toyota. Toyota is known for its reliability and fuel efficiency, making it a popular choice for many drivers. In this article, we'll explain how Toyota leasing works, the benefits of leasing a Toyota, and what you can expect during the application process. Whether you're new to leasing or just interested in learning more about Toyota leasing options, this article will provide the information you need to make an informed decision.

The Definition of Car Leasing

Car leasing is a type of financing where you pay to use a car for a specific period of time, typically between two to four years. The payments you make during the lease term are based on the car's depreciation value, calculated by the difference between the car's initial value and its residual value at the end of the lease.

Differences between buying and leasing a car

When you buy a car, you own it outright and can customize or modify it as you, please. However, you are responsible for all maintenance and repair costs, and the car's value may decrease over time. On the other hand, leasing a car provides a more affordable option for those who want a newer car every few years. You can enjoy the benefits of a new vehicle without paying the total ownership cost. However, you are limited in terms of modifications and may be subject to mileage restrictions and other fees.

Advantages and disadvantages of car leasing

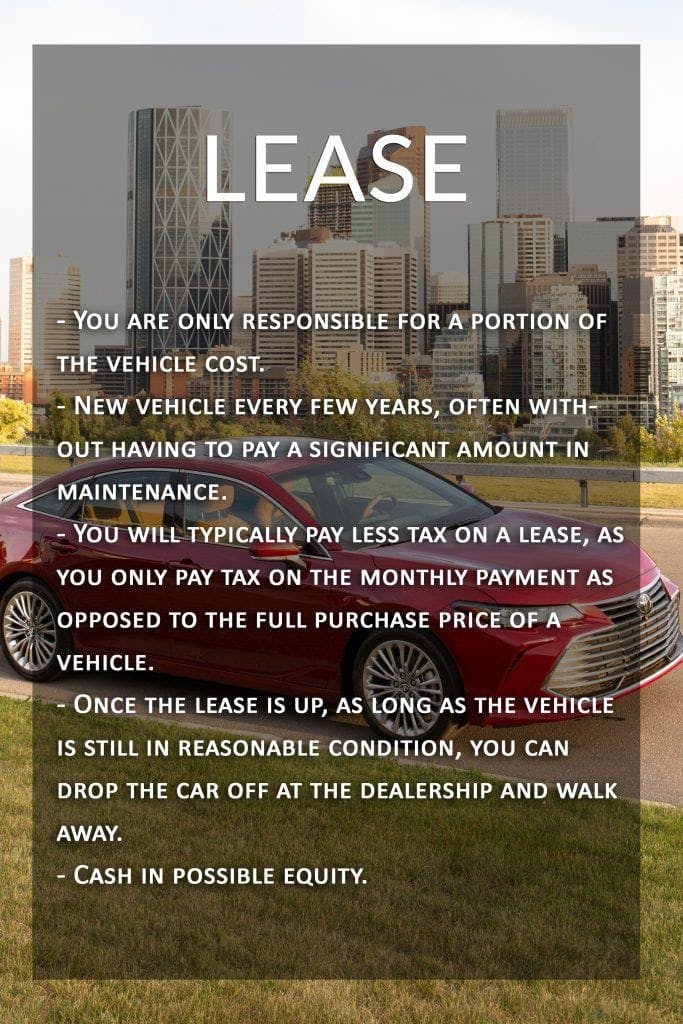

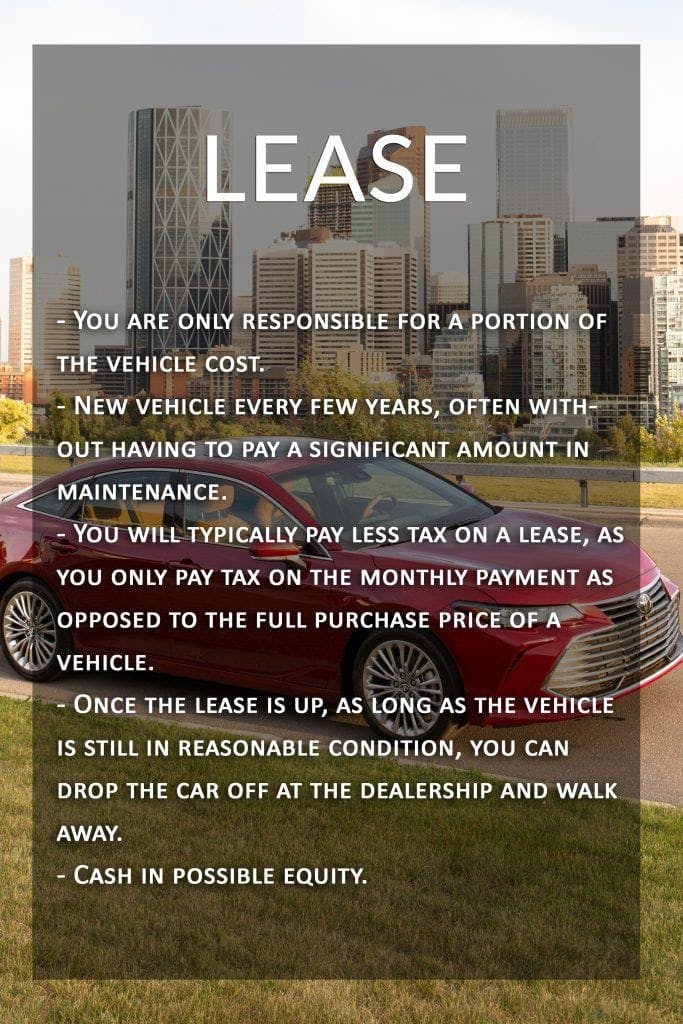

One advantage of car leasing is the lower monthly payments than financing a car. Since you only pay for the car's depreciation value, your monthly payments are typically lower than if you were financing the entire vehicle cost. Leasing a car also means you can enjoy a new car every few years without worrying about the long-term commitment of ownership.

However, leasing also has its disadvantages. You may be subject to mileage restrictions and other fees if you exceed a specific limit or return the car in poor condition. You also do not own the car, which means you have no equity in the vehicle and cannot sell it for a profit. Additionally, you may have to pay extra fees if you terminate the lease early or want to modify the car.

Overview of Toyota leasing options

Toyota offers various leasing options, including the traditional lease, the Toyota lease loyalty program, and the Toyota lease-end program. The standard conventional lease allows you to lease a Toyota for a predetermined period, including options such as mileage allowances and additional protection plans. The Toyota lease loyalty program offers incentives for returning customers, such as reduced lease-end fees and lower monthly payments. The Toyota lease-end program provides options for customers at the end of their lease term, including the option to purchase the vehicle, lease a new Toyota, or return the car.

Benefits of Toyota leasing options

One benefit of leasing a Toyota is the brand's reputation for reliability and low maintenance costs. Toyota vehicles are known for their long lifespan and high resale value, which can reduce the overall cost of leasing. Toyota also offers competitive pricing and a variety of leasing options to fit different budgets and needs. Toyota's lease loyalty program rewards returning customers with added incentives and benefits.

Comparison of Toyota leasing options with competitors

Compared to other car manufacturers, Toyota's leasing options are highly competitive. Toyota offers a range of leasing terms and mileage allowances, and the brand's reputation for reliability can result in lower maintenance and repair costs. Toyota's lease-end program also provides flexible options for customers at the end of their lease term. However, comparing Toyota's leasing options with other manufacturers is important to ensure you get the best deal for your specific needs and budget.

Toyota leasing requirements

To lease a Toyota, there are specific requirements you must meet. These requirements may vary depending on the leasing program and your credit history. Generally, you must provide proof of income, a driver's license, proof of insurance, and a credit check. You may also be required to give a down payment or security deposit.

Eligibility criteria for Toyota leasing

To be eligible for Toyota leasing, you must meet specific criteria. This includes having a good credit history, a stable income, and meeting the age and residency requirements. Typically, you must be at least 18 years old and a legal resident of the United States to lease a Toyota. Some leasing programs may have additional eligibility requirements, such as a minimum credit score or a certain debt-to-income ratio.

What to expect during the application process

The application process for leasing a Toyota is similar to applying for a car loan. You must complete an application, provide the necessary documentation, and undergo a credit check. If you are approved for the lease, you will receive the terms and conditions of the lease agreement, including the monthly payment amount, mileage allowance, and any additional fees. It's important to carefully review the lease agreement before signing it to ensure you understand all the terms and conditions of the lease. Once you sign the lease agreement, you can take possession of the car and begin making monthly lease payments.

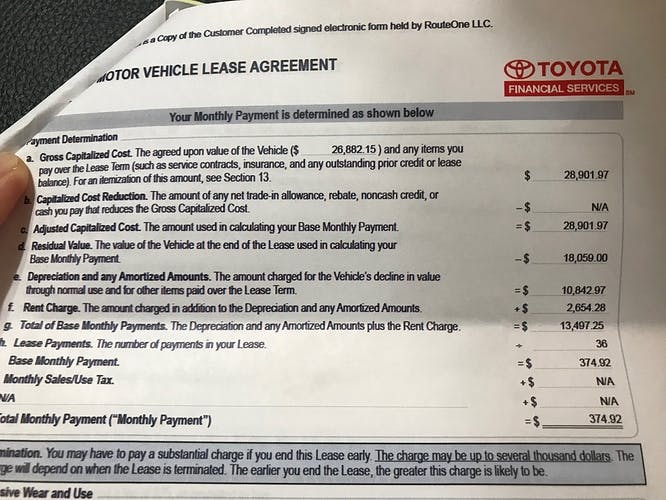

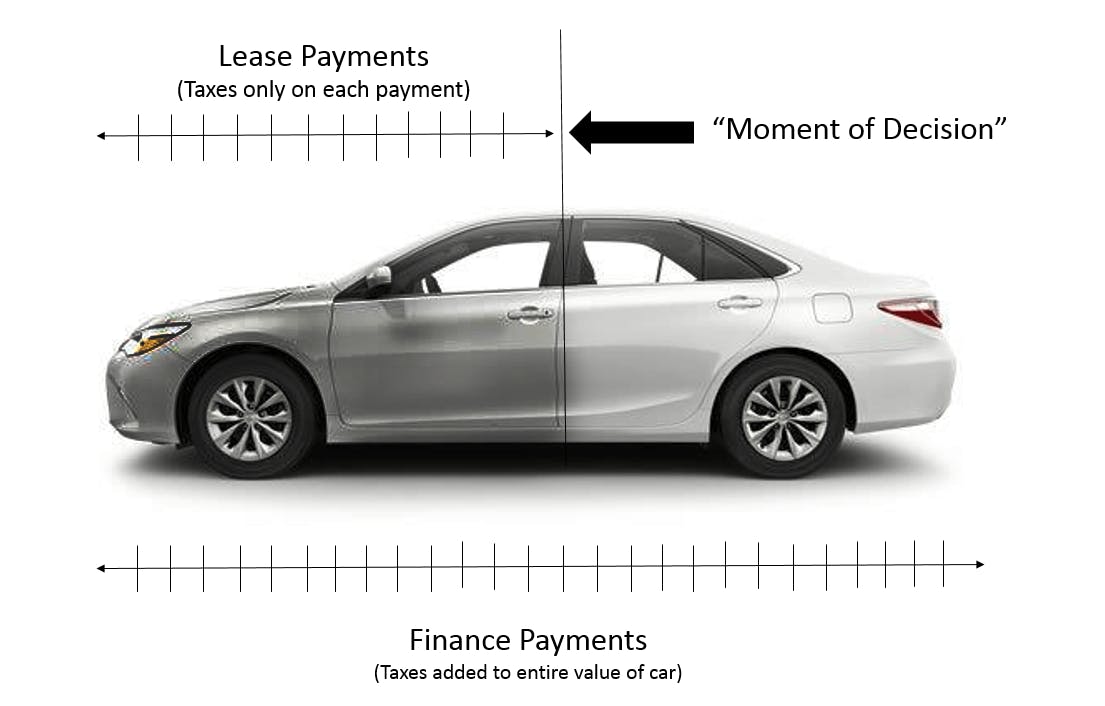

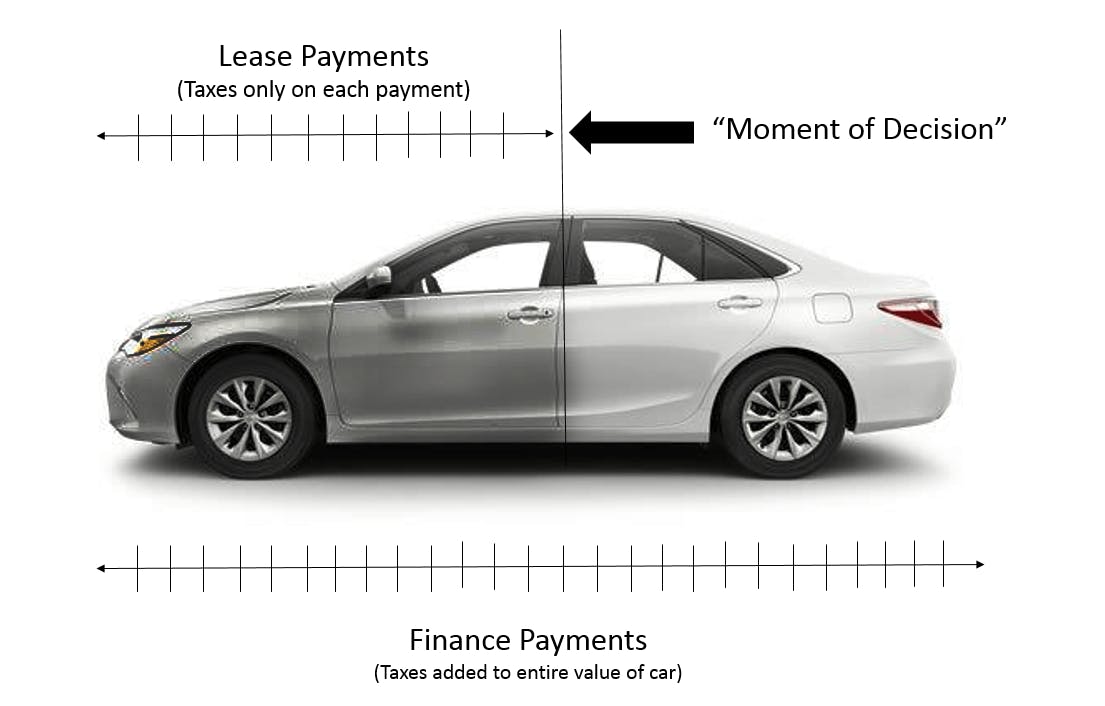

How Toyota lease payments are calculated

Toyota lease payments are calculated based on the car's estimated depreciation during the lease term. The lease payments are determined by subtracting the residual value (the vehicle's estimated value at the end of the lease term) from the car's initial value and applying the money factor for the rent charge. The resulting amount is then divided by the lease term to calculate the monthly lease payment.

Explaining residual value

The residual value is the estimated value of the Toyota at the end of the lease term. The manufacturer uses the car's age, condition, and mileage to determine the residual. The higher the residual, the lower the payments. At the lease end, you can purchase the vehicle at the residual value price, return it, or trade it in for a new lease.

Explaining money factor

The money factor is similar to an interest rate on a car loan. The interest charged on the lease amount is expressed as a decimal. The leasing company determines the money factor. It is based on the lessee's credit score, the car's residual value, and the lease term's length. The money factor calculates the lease's finance charge, which is added to the monthly lease payments. A lower money factor will result in a lower overall lease cost.

End of your Toyota Lease

At the End of a Toyota lease, you have several options. You can return the car to the dealership and lease or purchase a new vehicle, purchase the leased car at the agreed-upon residual value, or return the car and walk away with no further obligations. Exploring all of your options at the end of your lease is essential.

Lease-end responsibilities

As the lessee, you are responsible for returning the leased car in good condition, with normal wear and tear. Any damage or excessive wear and tear may incur additional fees or charges. Additionally, you are responsible for ensuring the car has been properly maintained and serviced throughout the lease term. It's important to review the lease agreement for specific requirements and responsibilities.

Lease-end fees

Additional fees or charges may be at the end of a Toyota lease. These include a disposition fee, which is charged when you return the leased car to the dealership, and any excess mileage fees if you exceed the agreed-upon mileage allowance. Also, suppose there is any car damage or excessive wear and tear. In that case, you may be charged for repair or replacement parts. Reviewing the lease agreement for specific details on fees charged at the end of the lease term is important.

In Summary, Toyota leasing is a popular option for individuals who want to drive a new car without the commitment of owning it. Toyota offers various leasing options with benefits such as lower monthly payments, flexible lease terms, and the ability to upgrade to a new vehicle every few years. The application process requires meeting specific eligibility criteria, undergoing a credit check, and providing necessary documentation. Once approved, the lease payments are determined by the car's depreciation value during the lease term, residual value, and money factor.

If you are considering leasing a Toyota, it's important to research the options available and determine which option best fits your needs and budget. Before signing the lease agreement, carefully review the terms and conditions to ensure you understand all the requirements, responsibilities, and fees associated with the lease. Additionally, consider the end-of-lease options and commitments to help plan for the future.

Toyota leasing can be an excellent option for individuals who want to drive a new car without the long-term commitment of owning it. With various leasing options and benefits, Toyota leasing provides a convenient and affordable way to drive a new car. However, it's important to consider your individual needs and budget before deciding if leasing is the right option for you. By researching and understanding the leasing process, you can make an informed decision and enjoy the benefits of driving a new Toyota.

You can always check the current lease specials from Toyota of Gladstone at Toyota Incentives and Offers.